Getting in front of investors is an uphill battle. Some clients have described it as “near impossible,” “an exercise in sheer will,” “the hardest thing I’ve ever done,” and even “humiliating.” And after all that work, you have just one chance to impress investors.

When you’ve only got one shot, the most important thing is to be prepared.

Being prepared means a lot of things. It means being well-rehearsed, having your numbers down, understanding your business drivers, knowing your strategic plan and being able to answer questions before your investors even ask them. Below is our guide to all this—your roadmap for impressing investors.

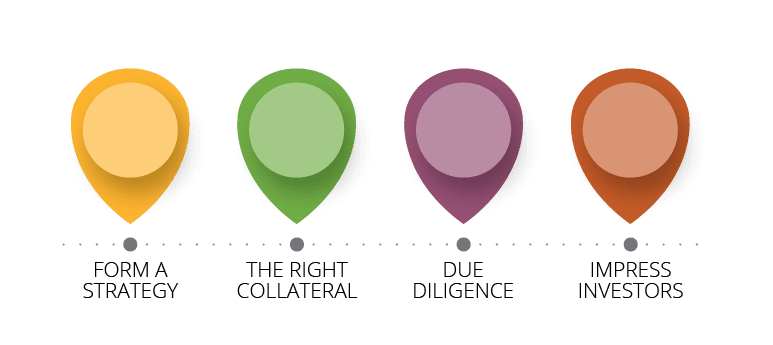

First Things First: Form a Strategy

Having a good strategy to reach investors will maximize the value of time spent fundraising. Fundraising is intense and extremely time-consuming. It’s easy to get overwhelmed by the magnitude of the task. It tends to divert energy from your business, but that means your business can actually suffer while you’re out raising money.

Fundraising is one of the riskiest times for your business, because customer growth and acquisition is often just as important as getting additional funds for the business to grow (if not more so). Without customers, it’s going to be hard to show traction, and the clear understanding of your market that you’ll need in order to prove the viability of your concept during the fundraising process. This is a huge catch-22 and a delicate balancing act to impress investors.

To make sure you’re using your energy and time strategically, start forming your plan by asking yourself these questions:

- Who is your ideal investor?

- What kinds of investors typically invest in your industry?

- Who is landing big deals in your industry?

- Where does your ideal investor live?

- Who do you know that knows your ideal investor?

- How can you generate more buzz, connections, or awareness among your ideal investors?

Make a clear action plan, with metrics on how you will engage and connect with potential investors:

- Who will you cold call/cold outreach?

- How many connections do you need to get an introduction?

- If they aren’t ready to talk, how will you engage them over time?

- What will you send them? When will you send it to them?

Have the Right Collateral

When you’ve only got one shot, having the right collateral is key. The modern world is full of great design. To stand out, appear professional, and effectively convey information, a professional investor deck and other fundraising collateral is crucial.

At Pitch Deck Fire we’re all about building the perfect investor pitch deck, so that you can impress your investors and get maximum value from every interaction you have with them.

Our clients often say they’re lost in the weeds of their business, not particularly confident with their design capabilities, and unsure of how to authentically tell the story of their company in a way that investors find compelling. They’ve found that designing a pitch deck themselves is time consuming and frustrating, and it always results in poor quality. Hiring a professional designer allows them to stay focused on running their business: customer growth, building a robust investor strategy, and doing what it takes to execute on it. They are well prepared to succeed when they do get a much-desired meeting.

Don’t trip over pennies to make millions.

Work with Experts

Work with experts to craft the best message for your company and funding collateral. Do this early with the right team to allow you to get your story straight, get your sales teams aligned, and demonstrate as much customer traction as you can early on in the formation of your business.

Gaining traction through pre-sales or customer feedback will go a long way towards attracting investors. After all, lots of customers generally translates to a good return on an investor’s contribution to your company. So any kind of sales you can generate during fundraising time will enhance your case for investors. Plus, with organic growth, you may even be able to self-fund your company and keep more of your equity. So it’s a win-win scenario to focus on traction and landing early sales.

Prepare for Due Diligence

Due diligence is the extra research that a potential investor will do when considering an investment in your company. Get in front of this process as much as you can with your own diligence! This makes everybody’s lives easier. Know your numbers, your plans for growth, and the drivers of your business success.

Make sure you have answers to these questions:

- What is my Go to Market or Growth plan?

- How many customers do I need to acquire, and by when?

- How will I accomplish these plans and what will that cost?

- What are my financial projections and assumptions underlying these projections?

With a strong and practical focus on diligence, you can preemptively answer questions from investors who are seriously considering your company. You can position your funding needs and business capabilities in the most compelling way possible. This ties together with your pitch deck creation, since the designers you work with should be able to weave a cohesive story with the compelling graphics and content to support this underlying message and instill confidence in your investor audience.

Get Out There & Wow ’Em!

If you can do all this, and you can start doing it early, you will set your business up for success from the very beginning and impress investors.

You’re going to spend a lot of time and energy getting in front of the right investors. Being well-prepared will go a long way towards convincing your audience that you’re the right person to work with. Remember, your ability to tell your story relates directly to customer-facing marketing, and knowing the strategic plan behind it relates directly to operational effectiveness and good stewardship of investment funds. In this way, you can clearly show through action (and not just message) your viability as a company, and your value as a good investment.