It’s late at night, after a long day of building your business. You’re exhausted. The market slide on your pitch deck is on your mind.

Tomorrow you are pitching at a local pitch event, hoping to generate some buzz about your startup, maybe meet a potential investor, and fingers crossed win the competition. At least those were the high hopes you’d had when you signed up for this event.

Now it’s the night before and besides a few cursory looks at an old draft of your pitch deck, you really haven’t spent a lot of time preparing for the pitch. In an optimal scenario, you would have spent time putting together a stellar pitch, worked with a pitch deck design team to make sure the deck visually tells your message, and practiced your pitch over and over again getting feedback and expert advice to make it the best that it can be. But, unfortunately you didn’t do that yet. So instead, you’re looking at this blank deck, exhausted and kicking yourself for having ever signed up for this pitch competition tomorrow.

At this point you may do a little research and find a bunch of articles on the “10 slides you need in your pitch deck.” And in a hurry you decide to move forward with this “safe”, if formulaic, approach. Problem statement, check. Solution, yep got it. Market size, wait.. what does that even mean? And how do you find that information? And how should that slide look? Is it just a bunch of numbers? Ah! It’s midnight and you haven’t even gotten to slide 4 of the 10 slides you need!

The team here at Pitch Deck Fire has your back. We’ve gathered our collective insight into putting together a market size slide based on our experiences in doing so for hundreds of startups in all different industries. It’s not as hard as it seems, but it is just as objective & nebulous as it sounds. In this article, I’ll talk about how to gather the information you need, some common ways to “break up” your market size, and major pitfalls to avoid on your market slide(s) on your pitch deck.

The Point of a Market Slide on the Pitch Deck

What are we even doing a marketing slide for? Why does an investor care? For the numbers-focused potential investor, the need for this information is clear. I’ll lay it out step by step. So you have this widget that you make. This widget is great and it solves a real problem in the real world felt by real people with real money. That’s great! This is a viable business idea… almost. What if there are only 2 people? What if those people have no money?

Your business needs to be able to sell this widget for enough money that it not only covers your costs but generates a profit. And for a potential investor who is considering whether or not to give you money, the amount of profit you have the likelihood to make is a direct reflection on whether they will get a return on their investment. And unless this is a non-profit donation, a return on the investment is the whole reason the investor is investing in your company in the first place.

So if we need to prove that we can make money with the sale of this widget, then we need to answer some key questions: How many people who are likely to buy the widget are there? How much are they willing to spend? How much money do they already spend on similar things? Is there industry wide information for your field? How many of the people that we identified are prime targets? If you can answer these questions clearly and in a compelling way, we can triangulate how much opportunity there is for our startup in the market, then we can make a case for our future success and return for our investors.

Gathering Information for Market Size

As silly as this sounds, skilled google searches are some of the best ways to get the information you need. Libraries are often outdated, and industry publications can be expensive. There is a wealth of information available on the internet both statically and in citations of other articles or publications. To gather the market information, start searching for the “Widget industry yearly revenues” and “number of widget customers” and “Global widget sales” or “National Widget sales.” etc.

Read articles that look promising and are from reputable sources. In the articles that you find, visit the citation sources themselves and see if you can find the source articles or documents in full for even more information and tangential numbers. If you have access to or see a reference to a particularly pertinent industry publication, it may be worth the purchase for more in-depth information. An interesting place to find relevant statistics is a site called “Statista.com.” They have free and premium access levels that may meet your needs.

Gather all of the numbers that you can. Record links to the sources so you can re-reference at any time. Make sure you know what the numbers are, what they are referring to and how they relate to each other. This is your starting point.

Break Up Your Market

As you’re sifting through the hundreds of pages of results that google will happily deliver to you, and going down rabbit holes on each of the relevant articles that you find, what are you looking for? You’re looking to answer these questions about your target customer:

How many?

What amount of your target customers are there? How can you break them into groups? Which ones are more interested than others? Where are they located? Who are they (Women? men in their 50’s? Lawyers in Colorado?)?

How much?

How much are they willing to spend? What do they spend on similar things already? How much is it worth to them? What amount of money do they have available to spend on things like this? What amount do they waste not having this solution?

At what interval?

At what interval will they buy this? (Once, every year, daily?) How often will they use it? Will it wear out? Is their usage based on some other factor (like number of transactions? Trips taken?) How often will that be triggered?

Overtime?

What has been happening in the industry over time? Is it growing? Shrinking? What is the CAGR (compound annual growth rate)? Is there relevant change in the industry that has happened recently or is expected to disrupt historical volumes in the future?

Wide Industry #’s

Overall, how big is the industry? Often if it is well known enough, these numbers are tracked by authorities like ISBN. Like “Commercial Real Estate in the US.” These are good starting points to get the big numbers, but not sufficient in and of themselves.

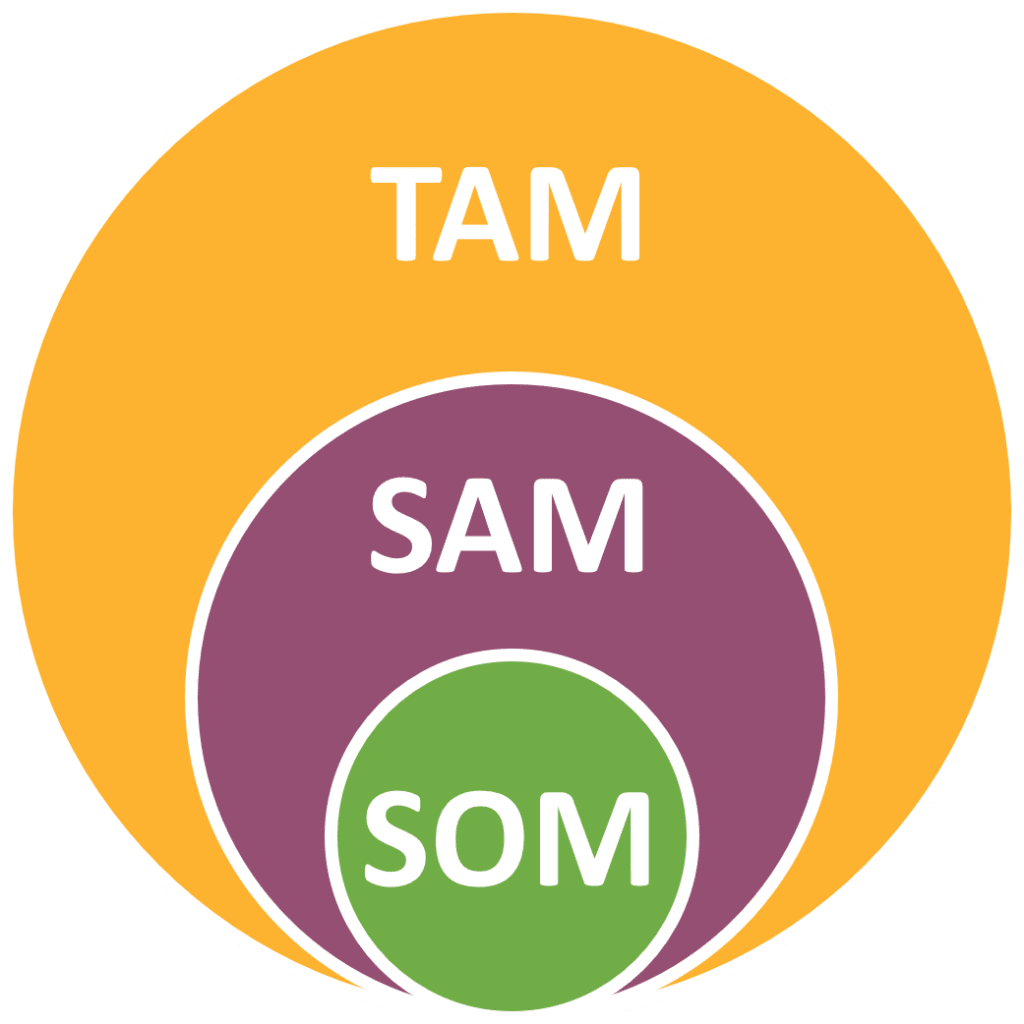

TAM, SAM, and SOM

Nope, this is not a nursery rhyme. TAM, SAM and SOM are common acronyms for a specific way to break up your market size that have been used by some well known start ups in their pitch decks. They are also terms that many investors (especially institutional investors) will understand.

TAM – Total Achievable Market

The total achievable market is a number that represents the total demand for a product or service. This is the top level number. The TAM might be geographically bigger than your business can reach right now, the number may cover people only mildly interested in the product or service or whom you identified as possible target groups based on demographics alone. This number could be the total revenues in a particular industry, it’s the “big” number.

SAM – Serviceable Available Market

The serviceable available market is a portion of the TAM that is targeted by your product your service. Usually this is in a more immediate geographic reach, or with some other level of targeting to make it a focused segment of your market. This is where we start to narrow things down.

SOM – Share of Market

The share of market is the portion of the SAM that you can actually/feasibly capture. This can be shown in a % of the SAM, for example: we can win 10% of the market share in the next 2 years. This is an interesting number because it takes into account the fact that you are not the only solution your customer has for your product or service. No company in the world (except for monopolies) have 100% of the market. So to make it seem like you expect to get 100% of a market would be completely incorrect.

Common Market Size Pitfalls

There are some common mistakes that founders make when putting together their market slide on their pitch deck. >>>For common mistakes founders make on their pitch deck, check out our article here <<< Generally speaking these mistakes are related to the numbers used and the claims made given those numbers. Your audience will be skeptical of the numbers you pose. And understandably so, they did not read the well-sourced articles you did. That and market size is a hard number to pin down, prove, and agree upon no matter how well researched. Don’t do these things:

The Once Percent Claim

You can guarantee that a potential investor will roll his eyes at this one: “This is a huge market, if we just capture 1% we’ll be millionaires!” I’ve actually heard this many times. But, that is just not going to cut it. How are you going to get 1% of that market? Do you even have a plan to do so? Is there even 1% of this market that might want your specific product? Saying the market is billions and we can make millions if we capture a small percent of it is not valuable or real. Be more specific.

Bad Math

You’ll be gathering a lot of numbers for this slide. Adding up numbers that can’t be added up is a common mistake that I see. Let’s say you run a company for “The Uber of Dogwalking” I’m sure you can understand who the target customers are for this app, dog owners and dog walkers. In doing market research perhaps you find the following pieces of information (totally made up numbers):

- 10 Million people own dogs

- 2 Billion people own a smart phone

- 100K people are listed as dog walkers

TOTAL MARKET = 2,010,100,000 Potential Customers

This is not good math. Some smart phone owners are dog owners. In fact the ONLY people that this type of startup would target would be dog owners who ALSO have a smart phone. So they are targeting only the portion of the 10 million dog owners that also own a smart phone, not both. This is BAD math. Never do this. The same is true for $$s. If you have the market value of the application industry, and the market value of the dog walking industry, we CANNOT just add them together. That makes no sense.

I’ve laid this out in a pretty easy-to-see way above, but bad math can be harder to see in your case. Pay attention to where the statistics are from, what they refer to specifically, and always be careful of adding things together.

If you’re having some challenges gathering the information for your market slide on your pitch deck, or if you’ve gathered the relevant information but are not sure how to visually show this information on a pitch deck slide that tells the story visually, we can help. Pitch Deck Fire specializes in helping owners to tell their story through well designed, professional pitch decks. Beyond great design, our services include ensuring that the content on slides like your market slide is right and that the overall message for your pitch is clear and compelling.

Now, if you really do have that pitch competition in the morning, we may not be able to help you this time. But the best day to plant a tree is 40 years ago, the 2nd best day is today. So if you want to be ready for the next big pitch or investor meeting, sign up to talk to a project lead and pitch expert today. Master that market slide on your pitch deck.